Expecting the Unexpected

Expect the unexpected and plan for the unplanned. On January 1st, 2020, no one would have thought that we would be in the situation that we are today. Only in movies that depict pandemics have we ever been exposed to this idea. However, about 100 years ago the world experienced something much like this – The Spanish Flu. In 1918, schools, churches, theaters, pool halls, and other businesses were closed, and a term we have become used to hearing “social distancing” was the norm with public gatherings banned. The work of some researchers showed that cities that adopted interventions early, held them in place longer and layered them together were more successful in managing the epidemic and reducing related fatalities. A lesson learned from the Spanish Flu pandemic was that the pandemic itself is what really hurts the economy, not the measures taken to try to contain it. Researchers also concluded that the economies of the cities that intervened early and more aggressively did not necessarily perform worse and possibly grew faster after the pandemic was over.

In 2005, former President George W. Bush undertook developing a comprehensive pandemic plan including diagrams for a global early warning system, funding to develop new, rapid vaccine technology and a robust national stockpile of critical supplies such as face masks and ventilators. He worked with the World Health Organization, the United Nations, and went to Congress for funding. As time passed it became more difficult to get continued funding, staffing and support to continue the needed attention on this endeavor. Hopefully, a by-product of what we are going through today will be better planning for something like this in the future and utilizing what we know from the past to help deal with the present.

We know that you may be dealing with several concerns right now – your health, and your financial, social, and spiritual well-being, but do know that we are here to help where we can be of assistance. We have no crystal ball to predict what the future of the market will hold or control it, but we do have ways to help to make use of opportunities that are presented by the market fluctuations.

Our wish for you is to stay healthy and safe.

The Coronavirus and Market Declines

The world is watching with concern the spread of the coronavirus which has escalated over time to a pandemic situation. The uncertainty is being felt around the globe, and it is unsettling on a human level as well as from the perspective of how markets respond.

It is a fundamental principle that markets are designed to handle uncertainty, processing information in real-time as it becomes available. We see this happening when markets decline sharply, as they have recently, as well as when they rise. Such declines can be distressing to any investor, but they are also a demonstration that the market is functioning as we would expect.

Market declines can occur when investors are forced to reassess expectations for the future. The expansion of the outbreak is causing worry among governments, companies, and individuals about the impact on the global economy. Airlines and cruise lines are experiencing the toll it is taking on travel, and this is just an example of how the impact of the coronavirus is being assessed.

The market is clearly responding to new information as it becomes known, but the market is pricing in unknowns, too. As risk increases during a time of heightened uncertainty, so do the returns investors demand for bearing that risk, which pushes prices lower. Our investing approach is based on the principle that prices are set to deliver positive future expected returns for holding risky assets.

We can’t tell you when things will turn, by how much, or for how long it will last, but our expectation is that bearing today’s risk will be compensated with positive expected returns. That’s been a lesson of past health crises, such as the Ebola and swine-flu outbreaks earlier this century, and of market disruptions, such as the global financial crisis of 2008–2009. Additionally, history has shown no reliable way to identify a market peak or bottom. These beliefs argue against making market moves based on fear or speculation, even as difficult and traumatic events transpire.

An important role that we as financial professionals play is to help investors develop a long-term plan they can stick with in a variety of conditions. Financial professionals are trained to consider a wide range of possible outcomes, both good and bad, when helping an investor establish an asset allocation and a plan. Those preparations include the possibility, even the inevitability, of a downturn. Amid the anxiety that accompanies developments surrounding the coronavirus, decades of financial science and long-term investing principles remain a strong guide.

source information:

Information for this article was primarily provided by Dimensional Fund Advisors LP which is an investment advisor registered with the Securities and Exchange Commission.

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment

advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized copying, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

History Shows That Stock Gains Can Add Up After Big Declines

Sticking with your plan helps put you in the best

position to capture the recovery.

Sudden market downturns can be unsettling.

But historically, US equity returns following sharp downturns have, on average, been positive.

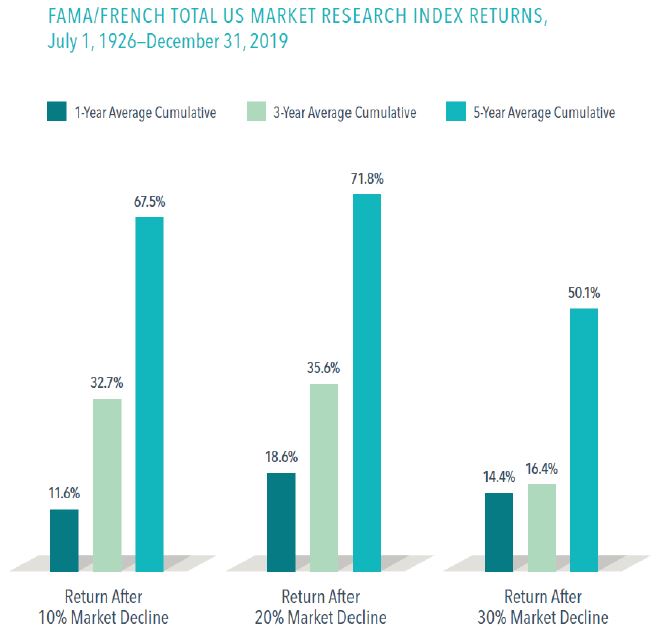

A broad market index tracking data since 1926 in the US shows that stocks have tended to deliver positive returns over one-year, three-year, and five-year periods following steep declines.

Cumulative returns show this to striking effect. Five years after market declines of 10%, 20%, and 30%, the compounded returns all top 50%.

Viewed in annualized terms across the longest, five-year period, returns after 10%, 20%, and 30% declines have been close to the historical annualized average over the entire period of 9.6%.1

source information:

1 The average annualized returns for the five-year period after 10% declines were 9.33%; after 20% declines, 9.66%; and after 30% declines, 7.18%. Past performance is no guarantee of future results. Short-term performance results should be considered in connection with longer-term performance results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

Market declines or downturns are defined as periods in which the cumulative return from a peak is –10%, –20%, or –30% or lower. Returns are calculated for the 1-, 3-, and 5-year look-ahead periods beginning the day after the respective downturn thresholds of –10%, –20%, or –30% are exceeded. The bar chart shows the average returns for the 1-, 3-, and 5-year periods following the 10%, 20%, and 30% thresholds. For the 10% threshold, there are 28 observations for 1-year look-ahead, 27 observations for 3-year look-ahead, and 26 observations for 5-year look-ahead. For the 20% threshold, there are 14 observations for 1-year look-ahead, 13 observations for 3-year look-ahead, and 13 observations for 5-year look-ahead. For the 30% threshold, there are 6 observations for 1-year look-ahead, 3-year look-ahead, and 5-year look-ahead. Peak is a new all- time high prior to a downturn. Data provided by Fama/French and available at mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Financial Preparedness

It is ironic that the month of April was National Financial Literacy Month. April was designated by Congress in 2004 to raise awareness and the importance of financial education and the serious consequences that may be associated with a lack of understanding about personal finances. The coronavirus pandemic has underscored the need to encourage people to financially prepare for such disruptions that can negatively affect their personal finances.

An emergency fund or an adequate amount of money in available savings for unexpected and unforeseen circumstances is needed during periods like what we are currently experiencing. Managing debt and expenses and not living beyond your means may require personal budgeting. Preparing for and having a financial plan for future expenses such as your children’s education or your retirement need to be planned for. All of these factors need to be considered in arriving at your personal risk/reward profile in order to meet your financial goals.

Only 21 out of 50 states require students to study financial literacy in high school. This leads to many adults who do not know how to handle a financial emergency or crisis. We will face these emergencies from time and time. There is a need for us to discuss and train our youth in the basic principles of personal finance for them to gain any financial resilience during times such as these.

One take-away from this coronavirus pandemic is that basic skills, preparation, and planning can and will help us navigate through turbulent times such as these and help us to remain strong financially despite putting up with challenging circumstances.