Presidential Election Reflection

“Over decades, it’s American innovation that succeeds, no matter what politicians do.”

— David Booth, November 6, 2020

With the U.S. presidential election called, and promising news of a COVID-19 vaccine announced, a U.S. market surge reminds us how keen investors are for a sense of closure. That said, who knows how long the mood will last? Come what may between the U.S. presidential election just ended and the inauguration yet to occur, the results will undoubtedly be attention-grabbing and action-packed. Social media and the popular press will see to that, as they feed on – and are fed by – our fascination over breaking news.

To counter all the excitement, we offer three calming insights:

(1) Cause and effect are rarely as direct as we might hope or fear.

Please apply this point to any temptation you may be feeling to alter your investments because “X” has just happened, or in case “Y” seems about to. As the election plays out, pundits will be proclaiming they can predict how the markets will respond to new socioeconomic policies coming out of a new administration. At least in terms of tomorrow’s market prices, they do not know. They cannot know. There are simply far too many interacting interests to make the call.

(2) It’s much easier to explain an outcome than to predict it.

In a Forbes column, the author describes how scientists have detailed models for explaining why volcanoes occur. But they still cannot predict each eruption. The same can be said for financial markets. We have excellent models for explaining a market’s overall factors and forces. But our ability to predict its individual events or specific moves remains as elusive as ever.

(3) Elections come and go. Your investments last a lifetime.

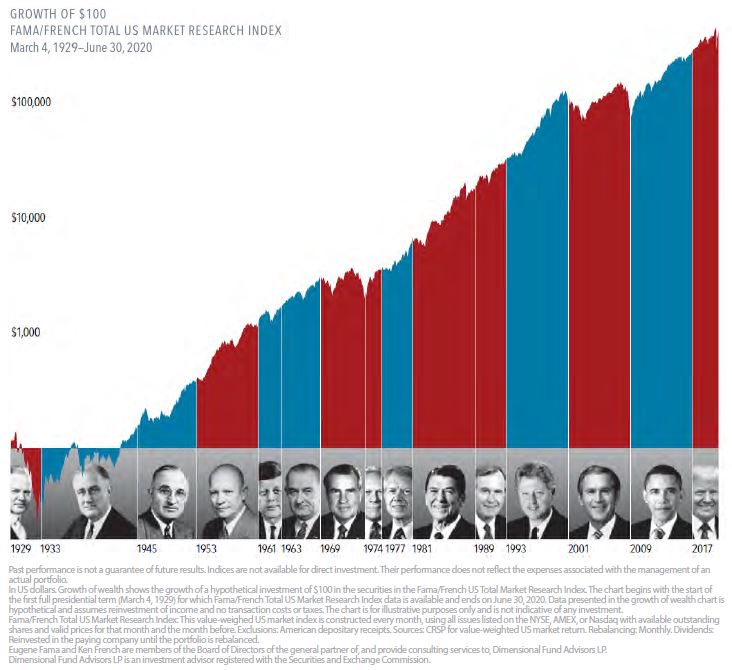

As U.S. voters, we have the opportunity to select our next president every four years. As investors, we are best served by measuring the balance of power in our portfolio across decades rather than years. As Dimensional Fund Advisors has demonstrated in the illustration on the following page, “for nearly 100 years of U.S. presidential terms [the data] shows a consistent upward march for U.S. equities regardless of the administration in place.”

In other words, politics aside, your best chance for achieving your personal financial goals remains the same: Continue to give your investments ample time and space to benefit from the market forces just described. As we move forward together, we hope you continue living according to your values, but heed this valuable advice about your lifetime investments. Stay the course!

What History Tells Us About U.S. Presidential Elections and the Market

It’s natural for investors to look for a connection between who wins the White House and which way stocks will go. But as nearly a century of returns shows, stocks have trended upward across administrations from both parties.

• Shareholders are investing in companies, not a political party. And companies focus on serving their customers and growing their businesses, regardless of who is in the White House.

• U.S. presidents may have an impact on market returns, but so do hundreds, if not thousands, of other factors—the actions of foreign leaders, a global pandemic, interest rate changes, rising and falling oil prices, and technological advances, just to name a few.

Stocks have rewarded disciplined investors for decades, through Democratic and Republican presidencies. It’s an important lesson on the benefits of a long-term investment approach.

Lump-Sum Investing vs. Dollar-Cost Averaging

How should you invest available cash? Should you invest it all right away as a lump sum? Or are you better off wading in more gradually with dollar-cost averaging?

Lump-sum investing is generally expected to generate the highest returns over time. In markets that have risen more, and more often than they’ve fallen, the sooner you deploy your investable assets, the more time they have to grow. That said, general rules don’t always apply to you. Let’s look at when dollar-cost averaging may be preferred after all.

Considering the Big Picture

First, it’s important to emphasize:

No matter which way you go (lump sum vs. dollar-cost averaging), it’s unlikely to matter nearly as much as whether you invest efficiently to begin with.

By this, we mean:

1. Planning: Start with an investment plan that reflects your personal goals and risk tolerances.

2. Investing: Invest according to your plan in a balanced mix of low-cost, globally diversified index or index-like funds.

3. Staying the course: Sticking to your investments over time and through various conditions.

If you can do all that, exactly how and when you add new money is less significant. The best approach for you is the one that helps you best adhere to these sensible investment practices.

Considering Your Best Interests

So, next, let’s turn away from theoretical returns and toward the main event: You. Behavioral finance informs us, we are all subject to cognitive biases that subconsciously influence our decisions. As such, even if a strategy returns X% over Y amount of time, you’re unlikely to receive those returns if the strategy is not a good fit for your circumstances.

Let’s illustrate. Imagine you received $24,000 to invest in early March 2020, just as the COVID-19 pandemic took off, and markets were beginning to falter. If you had decided to invest your lump sum right away, you would have had to soon watch it plummet amidst popular press outcries about “the fastest bear market ever,” “the worst first quarter in history,” and “the most volatile month on record.” It just so happens, you would have come out okay had you stuck with it through the next two quarters. But nobody knew that at the time; things could have easily gotten worse instead.

Either way, would you really have been able to stay the course with a March 1 lump sum decision? Or would you have leaped back out – or never jumped in to begin with? If you had decided to wait until the market seemed more stable, you’d probably still be waiting.

If fully investing in early March would have been too daunting, dollar-cost averaging might have been better than waiting for an “all clear” signal that has yet to arrive. By setting up an automatic schedule for dripping your $24,000 into the market over time, you could have benefitted from some of the market recovery that has taken place, while shielding some of your wealth had the market instead continued to decline.

Intentions vs. Outcomes

In short, lump-sum investing is generally expected to deliver better long-term returns if you are willing and able to stick with the strategy. But dollar-cost averaging may be the better choice if a more cautious (but still brave!) approach helps you better adhere to the larger, more important tenets of efficient investing.

So, how do you decide? That’s where our Firm comes in as your fiduciary advisor. We can help you objectively assess the personal and financial trade-offs involved based on the best information available at the time. We can then help you stick to your well-devised plans over time and through life’s uncertainties. By choosing the investment strategy that makes the most sense for you and your temperament, you stand the best chance of achieving your financial goals, no matter what the markets have in store for us next.

Gratefulness

2020 will soon be behind us, for which many will be grateful. It has been a year that included civil unrest and violence throughout the United States, terroristic threats and activities throughout the world, a deeply politically divided U.S. Presidential election, and the Coronavirus that has affected everyone throughout the world. Volatility in the markets with all of this uncertainty and negativity in the news has been a natural response to everything that has been going on this year.

No one can predict accurately and consistently what the future will hold for us in 2021. We can be quite certain that the negative news by the media will continue, since negative news gets our attention and sells advertising. It is better to not pay too much attention to all of the negative noise out there. Remember that we will continue to help you take advantage of fluctuations in the market through rebalancing of your portfolios and that historically, the stock market has moved upward the majority of the time even though downturns in the markets are inevitable. If you have any questions or concerns, please contact us.

As we reflect on the past year, we need to recognize all of the blessings that we have enjoyed in 2020. The Coronavirus has not been easy to deal with, but it may have allowed us to have and take the time to stop and appreciate the small but good things that have happened to us, as well as, our spouses and families who enrich our lives daily. We are very fortunate and thankful to have had the opportunity to serve you as our clients in the past year and look forward to 2021 to continue our professional relationships with you.

With the widespread increase in the Coronavirus at this time, the upcoming holidays may look a bit different from which we are accustomed. Due to the virus, we may have empty seats at our holiday table, or we may not be able to travel to be with family this year. The news does sound optimistic on a vaccine against this virus, so hopefully we can get back to somewhat normal in 2021.

WE WISH YOU AND YOURS HAPPY HOLIDAYS AND A HAPPY, HEALTHY, AND PROSPEROUS NEW YEAR!