A Tale of Two Decades: Lessons for Long‑Term Investors

Looking at the US stock market since the turn of the century, you could be forgiven for thinking of Charles Dickens’ famous words.

The first decade of the 21st century, and the second one that’s drawing to a close, have reinforced for investors some timeless market lessons: Returns can vary sharply from one period to another. Holding a broadly diversified portfolio can help smooth out the swings. And focusing on known drivers of higher expected returns can increase the potential for long-term success. Having a sound strategy built on those principles—and sticking to it through good times and bad—can be a rewarding investment approach.

“THE LOST DECADE”?

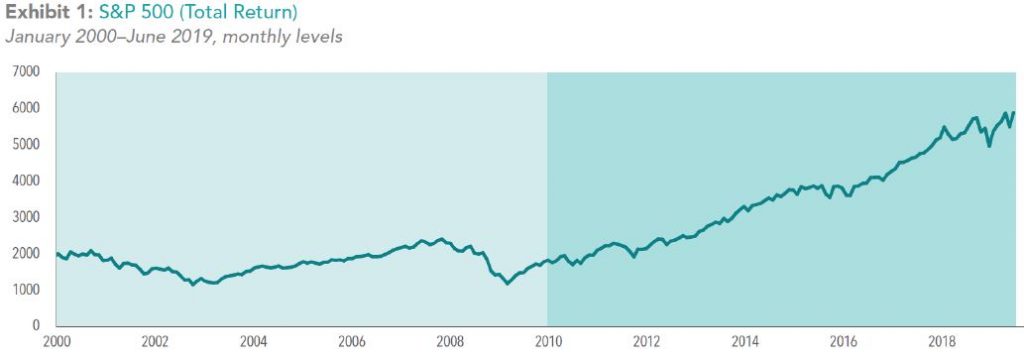

Looking at a broad measure of the US stock market, such as the S&P 500, over the past 20 years, you could be forgiven for thinking of Charles Dickens: It was the best of times and the worst of times (see Exhibit 1). For US large cap stocks, the worst came first. The “lost decade” from January 2000 through December 2009 resulted in disappointing returns for many who were invested in the securities in the S&P 500. An index that had averaged more than 10% annualized returns before 2000 instead delivered less than average returns from the start of the decade to the end. Annualized returns for the S&P 500 during that market period were −0.95%.

Yet it was a good decade for investors who diversified their holdings globally beyond US large cap stocks and included other parts of the market with higher expected returns—companies with small market capitalizations or low relative price (value stocks).

Performance does not reflect the expenses associated with the management of an actual portfolio.

S&P data © 2019 S&P Dow Jones Indices LLC, a division of S&P Global.

FLIPPING THE SCRIPT

The next period of nine plus years reveals quite a different story. It has looked more like best of times for the S&P 500, as the index, when viewed by total return, has more than tripled since the start of the decade in the bounce back from the global financial crisis. US large cap growth stocks have been some of the brightest stars during this span. Accordingly, from 2010 through the first half of 2019, many parts of the market that performed well during the previous decade haven’t been able to outperform the S&P 500. Since many of these asset classes haven’t kept pace with the S&P, these returns might cause some to question their allocation to the asset classes that drove positive returns during the 2000s.

THE CASE FOR GREAT EXPECTATIONS

It’s been stated many times that investors may want to take a long-term perspective toward investing, and the performance of stock markets since 2000 supports this point of view. Over the past 19½ years, investing outside the US presented investors with opportunities to capture annualized returns that surpassed the S&P 500’s 5.65%, despite periods of underperformance, including the most recent nine plus years. Cumulative performance from 2000 through June 2019 also reflects the benefits of having a diversified portfolio that targets areas of the market with higher expected returns, such as small and value stocks. And it underscores the principle that longer time frames increase the likelihood of having a good investment experience.

No one knows what the next 10 months will bring, much less the next 10 years. But maintaining patience and discipline, through the bad times and the good, puts investors in position to increase the likelihood of long-term success.

Investment Advisory Services provided through McMill Wealth Inc, a Registered Investment Advisor. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Investors should talk to their financial advisor prior to making any investment decision. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. All expressions of opinion are subject to change. This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.

A Timely Reminder on the Perils of Market Timing

It’s certainly understandable if the economic uncertainty unfolding in the daily news has left you wondering – or worrying – about what’s coming next. No matter how you feel about the U.S. entering into a trade war with China, it’s hard to deny that the situation is currently causing considerable market turmoil. One day there appears to be a resolution in sight, and the next day—not so much. Regardless of how the coming weeks and months unfold, are you okay with gritting your teeth, and keeping your carefully structured portfolio on track as planned? This probably doesn’t surprise you, but that’s exactly what we would suggest. (Unless, of course, new or different personal circumstances warrant revisiting your investments for reasons that have nothing to do with all the tea in China.)

That said, the news is admittedly unsettling. If you’ve got your doubts, you may be wondering whether you should somehow shift your portfolio to higher ground, until the coast seems clear. In other words, might these stressful times justify a measure of market-timing? Here are four important reminders on the perils of trying to time the market – at any time. It may offer brief relief, but market-timing ultimately runs counter to your best strategies for building durable, long-term wealth.

1. MARKET-TIMING IS UNDEPENDABLE.

Granted, it’s almost certainly only a matter of time before we experience another recession. As such, it may periodically feel “obvious” that the next one is nearly here. But is it? It’s possible, but market history has shown us time and again that seemingly sure bets often end up being losing ones instead. Even as recently as year-end 2018, when markets dropped precipitously almost overnight, many investors wondered whether to expect nothing but trouble in 2019. As we now know, that particular downturn ended up being a brief stumble rather than a lasting fall. Had you gotten out then, you might still be sitting on the sidelines, wondering when to get back in. The same could be said for any market-timing trades you might be tempted to take today.

2. MARKET-TIMING ODDS ARE AGAINST YOU.

Market-timing is not only a stressful strategy, it’s more likely to hurt than help your long-term returns. That’s in part because “average” returns aren’t the near-term norm; volatility is. Over time and overall, markets have eventually gone up in alignment with the real wealth they generate. But they’ve almost always done so in frequent fits and starts, with some of the best returns immediately following some of the worst. If you try to avoid the downturns, you’re essentially betting against the strong likelihood that the markets will eventually continue to climb upward as they always have before. You’re betting against everything we know about expected market returns.

3. MARKET-TIMING IS EXPENSIVE.

Whether or not a market-timing gambit plays out in your favor, trading costs real money. To add insult to injury, if you make sudden changes that aren’t part of your larger investment plan, the extra costs generate no extra expectation that the trades will be in your best interest. If you decide to get out of positions that have enjoyed extensive growth, the tax consequences in taxable accounts could also be financially ruinous.

4. MARKET-TIMING IS GUIDED BY INSTINCT OVER EVIDENCE.

As we’ve covered before, your brain excels at responding instantly – instinctively – to real or perceived threats. When market risks arise, these same basic survival instincts flood your brain with chemicals that induce you to take immediate fight-or-flight action. If the markets were an actual forest fire, you would be wise to heed these instincts. But for investors, the real threats occur when your behavioral biases cause your emotions to run ahead of your rational resolve.

We’d like to think one of the most important reasons you hired us as your financial advisor is to help you avoid just these sorts of market-timing perils – during just these sorts of tempting times. Even if you do everything “right” in theory, we still cannot guarantee your success. But we are confident that sticking with your existing plans represents your best odds in an uncertain world.

2020 — A New Year, A New Decade, What Does Your Crystal Ball Predict?

2019 is almost in the books. It has been a year of volatile markets, a year with trade wars with China and other countries, a new Prime Minister for Great Britain, a year plagued with terrorism and threats of terrorism and gun violence, and a year filled with political division between the Democratic and Republican Parties. In short, it was a year of uncertainty as most years are.

No one has a crystal ball that can predict what will happen in 2020. No one can predict with any accuracy exactly how the financial markets will go in 2020. Will we continue to have volatility in the markets? In the long run, it really doesn’t matter much. We will continue to take advantage of fluctuations in the market through rebalancing of your portfolios. Historically, the stock market has moved upward the majority of the time. Even though that is true, we know that downturns in the markets are inevitable. Don’t pay attention to all of the negative media hype. Remember that negativity sells advertising and is meant to get everyone’s attention—so beware. If you have any concerns, please contact us.

We should reflect on all of the blessings that have been bestowed upon us in 2019—family, friends, food, shelter, and health—just to name a few. Our business is based upon relationships cultivated with you—our clients. Many of our client relationships span more than one generation and are important to the success of our business. We are very fortunate to have had the opportunity to serve you as our clients in the past year and look forward to 2020 to continue our professional relationship with you. Sometimes, the many details that make up a holiday may seem trivial: preparing that favorite family recipe; reaching out to a special someone you’ve been meaning to call; coming home early from the office, even if your tasks aren’t yet complete. But remember, this season and year-round, over time, small acts create enormous events.

We wish you and yours happy holidays and a happy, healthy, and prosperous new year! May your holiday season be filled with cherished memories, both large and small!

Investments provided through Wealth Management LLC, a Nebraska LLC, Registered Investment Advisor.

This material is derived from sources believed to be reliable, but its accuracy and the opinions based thereon are not assured.

The articles and opinions in this publication are for general information only and are not intended to serve as specific financial, accounting or tax advice.