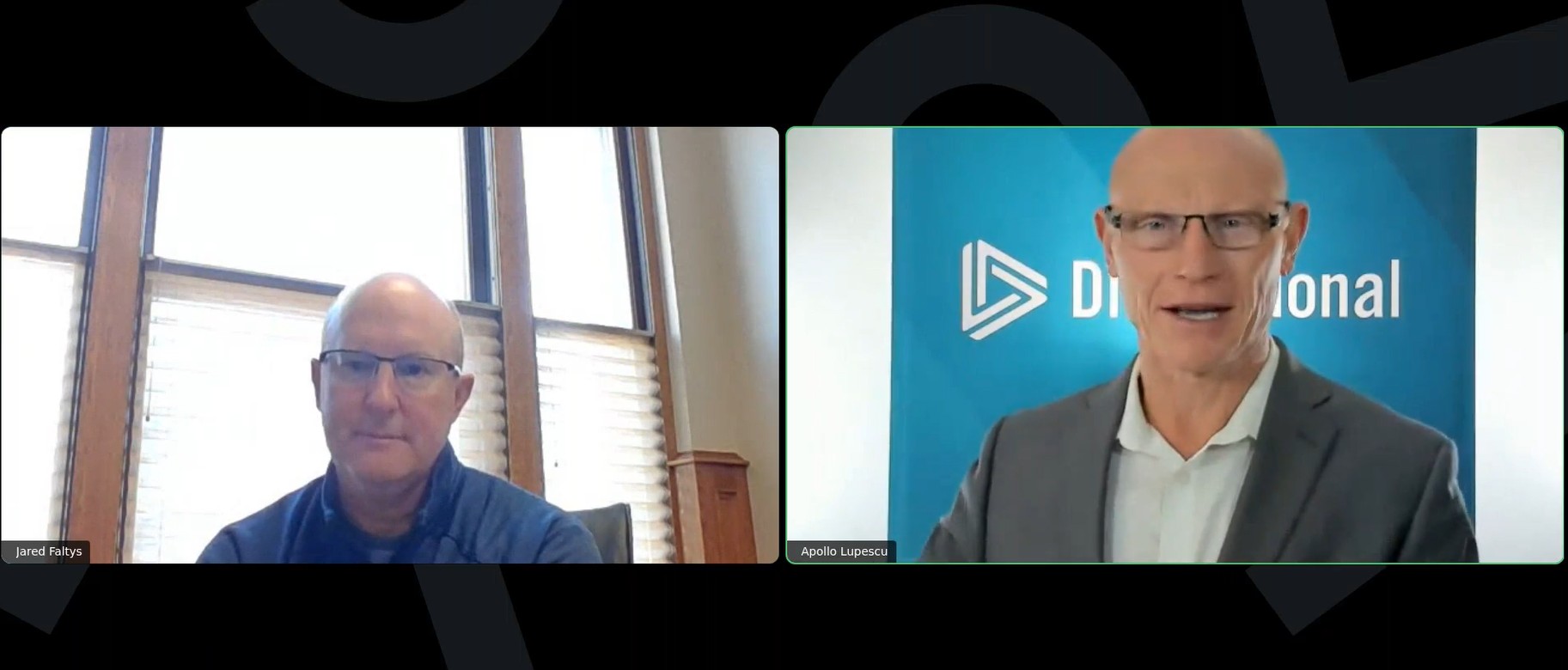

Dimensional Fund Advisors Vice President, Apollo Lupescu, PhD and Jared Faltys, CPA/PFS provide a current market update. Recorded October 16, 2025.

Category: Blog Post

It’s Not Tax Season, It’s Marketing Season

Webinar Recording | February 2024

Presented by Nate Raabe

During tax season, it is the best opportunity for CPAs and advisors to market their firm by showcasing the value-added services they offer. Make sure that during your meetings, your clients are aware of the services you offer, focusing on those that are tailored specifically to them. It shouldn’t be the clients job to ask about a specific service. The advisor should proactively recognize a client’s potential needs, so they are prepared for the meeting with any necessary resources. These services could include medical reimbursement plans and managing HSA contributions, proper entity setup, estate planning, retirement strategies, cost effective investment strategies, funding IRA’s, beneficiary designation discussions, etc.

When meeting with clients during tax season, an accountant should highlight tax-savings opportunities on the Form 1040. A thorough 1040 review can present opportunities to have conversations surrounding wages, interest income, dividend income, IRAs and pensions, capital gains and losses, net operating losses, medical expenses, etc. Review the Schedule 1 for alimony, business income, partnerships/S corps, farm income, unemployment, HSA deductions, self-employed SEP, SIMPLE and qualified plans, IRA deductions, etc. to look for potential opportunities. Review the Schedule 3 for education credits, etc.

If you are an advisor that has questions on how you can best tailor your services to help your clients achieve their financial goals, reach out to the professionals at Wealth Management.

INTEGRITY FOUNDATION LAUNCHES IMPACTFUL NATIONWIDE COMMUNITY INITIATIVE WITH STATE-OF-THE-ART PLAYGROUND BUILD IN NEBRASKA

Designed with input from 550 local children, playground was constructed in a single-day build by hundreds of Integrity leaders, employees and community volunteers

DALLAS – AUGUST 24, 2023 – Integrity Marketing Group, LLC (“Integrity”), a leading distributor of life and health insurance, and provider of wealth management and retirement planning solutions, today announced the Integrity Foundation has completed the first of many community legacy and support initiatives to come — building a state-of-the-art playground in Norfolk, Nebraska, to benefit generations of children and families. Located in Norfolk’s historic Liberty Bell Park, the playground was designed over several months and then built in one day through partnership with KABOOM!, the City of Norfolk, and Integrity partners Premier Marketing and WealthFirm. Integrity’s purposeful revitalization of this beloved park in the heart of the community will result in long-lasting and positive impact on the health and well-being of local children and families for generations to come.

The Norfolk playground build is one of the largest charitable endeavors led by Integrity’s recently established Integrity Foundation, a 501(c)3 public charity founded to drive meaningful and sustainable change that improves the health and wellbeing of the millions of people it serves nationwide. With an expansive national network of partners, employees, agents, customers and carriers, Integrity is uniquely positioned to mobilize its many stakeholders and connect them to enriching opportunities that help protect the life, health and wealth of people all across the country.

“The Integrity Foundation was created to put powerful action behind our core values of Integrity, Family, Service, Respect and Partnership in the communities where our partners and employees live and serve,” explained Bryan W. Adams, Co-Founder and CEO of Integrity. “This playground build is a great example of the countless far-reaching support initiatives to come — in communities throughout the nation — that reflect our mission to improve the interrelated pillars of life, health and wealth that affect all Americans. We’re honored to come together with our amazing partners at Premier and WealthFirm, as well as the City of Norfolk, to build a state-of-the-art play space where families will be able to recreate, thrive and spend meaningful time together for generations. It was especially important to drive this project forward in the community of Norfolk, which has been an important part of the Integrity story since the beginning. The joy this new playground brings is evident to anyone who visits, and we’re grateful we could support and enrich the lives of families as they plan for the good days ahead!”

Service is a cherished core value at Integrity. The company provides its employees with two full days of paid time off annually to serve in their communities in a wide variety of settings. To accomplish the colossal and impressive undertaking of building the entire structure top-to-bottom in one day, the Integrity Foundation utilized the time, talents and dedication of hundreds of volunteers. Coming together in a spirit of generosity, employees and family members from Integrity, Premier and WealthFirm united with community members to construct the massive playground and gathering spaces at a record-setting pace. Volunteers completed physically challenging tasks such as hand mixing over 13,000 pounds of concrete, moving 150 cubic yards of mulch weighing more than 100,000 pounds, assembling benches and picnic tables, as well as constructing and installing 22 key playground elements.

Before the historic build day, the playground structure itself was designed using input collected from more than 550 local children who submitted drawings of their dream playground. These designs were then reviewed by more than 200 community members who integrated them into the final artistic and functional design decisions — and the Integrity Foundation worked side-by-side throughout the entire process. The playground and picnic areas will serve as a gathering place for families and create an increased sense of belonging and civic pride for community members of all ages.

“We are deeply appreciative of all the Integrity employees who generously volunteered their time and energy to make this Build Day possible,” said Josh Moenning, Mayor of Norfolk. “The Integrity Foundation recognized a significant need in our community and in true Integrity fashion, the team rallied together to exceed our expectations in fulfilling it. This revitalized space in the heart of Norfolk will once again become a place of connection for our community and it wouldn’t have been possible without the unwavering commitment and support of the Integrity Foundation and those who lead it.”

“From its earliest beginnings, Integrity has been committed to giving back to the communities we serve,” said Tom Schueth, Co-Founder of Integrity and Premier. “We couldn’t be prouder that the Integrity Foundation’s first of many planned local playground initiatives is right here in our community — creating impressive momentum that will spread across the country. It’s exciting to think about the positive impact the Integrity Foundation will extend to communities far beyond Norfolk and it’s an incredible honor to support those efforts.”

“Creating this interactive playground leaves a legacy that benefits our community for generations,” shared Mike Wingate, Co-Founder of Integrity and Premier. “Some of our employees who helped build the playground grew up visiting and enjoying this park as kids — and now their kids and grandkids will play here with them. It’s another way Integrity acts on the principles and values of caring for and serving the needs of all Americans that the company was founded on.”

“Integrity is a company that truly puts its core values into action and exhibits a sincere willingness to lead with a servant’s heart,” said Nancy Brozek, Co-CEO of WealthFirm. “We’re grateful the Integrity Foundation gave us the amazing opportunity to come alongside them and contribute to such a meaningful local initiative. This project has reenergized the park’s vibrant history and created a fun, useable space for our entire community.”

“Integrity has always been incredible in the ways it supports its partners and today, they showed they support the health and growth of our community as well,” explained Jared Faltys, Co-CEO of WealthFirm. “It’s inspiring to be partnered with a company that cares about those they serve so deeply and wants to make a difference, and they consistently put that desire into meaningful action. The impact we can make when we work together as one is truly unlimited.”

Integrity and its partners have committed additional donations to continue sponsoring local initiatives that support the Integrity Foundation’s key focus areas of investment across the United States.

NEWS PROVIDED BY Integrity Marketing Group, LLC

Lemonade Camp 2023

Campers raised $619 for the Animal Shelter of Northeast Nebraska.

Be Aware of Fraudulent IRS Communication

In today’s digital age, scams and fraud have become increasingly prevalent, affecting individuals, businesses, and government agencies. One of the most common forms of fraud involves impersonating the Internal Revenue Service (IRS) to deceive taxpayers. To protect ourselves and our communities from falling victim to such schemes, it is essential to be aware of fraudulent IRS communications via phone, email, text messages, or social media.

Here is a hypothetical scenario of fraudulent communications:

Paula received a voicemail from an IRS employee asking for a call back on a toll-free number. She is current on her tax filing requirements and doesn’t owe any back taxes. So, she’s confused about why the IRS would contact her.

Paula is justified in being concerned. The IRS does not initiate contact with taxpayers by phone, email, text messages, or social media channels. Official IRS correspondence is sent through the US Postal Service. The letter provides detailed information regarding tax issues such as notices about discrepancies, bills for unpaid taxes, or requests for additional information.

Sometimes, the IRS may call taxpayers, but this is not common and usually follows an initial letter. During these calls, representatives never demand immediate payment or ask for credit card information over the phone.

Paula should call the IRS directly at 1-800-829-1040, not on the number left in the voicemail.

If you are experiencing tax scams, please report them to the IRS immediately. Click here for the contact information.

Client Profile is based on a hypothetical situation. The solutions discussed may or may not be appropriate for you.

source: https://e.clientlinenewsletter.com/mcmillcpasandadvisors

Stuff the Bus

In July 2023, Wealth Management employees donated school supplies to the Salvation Army’s Stuff the Bus event. This event supplied students with new backpacks and basic school supplies. For more information on this annual event, please call the Salvation Army at 402-379-4663.

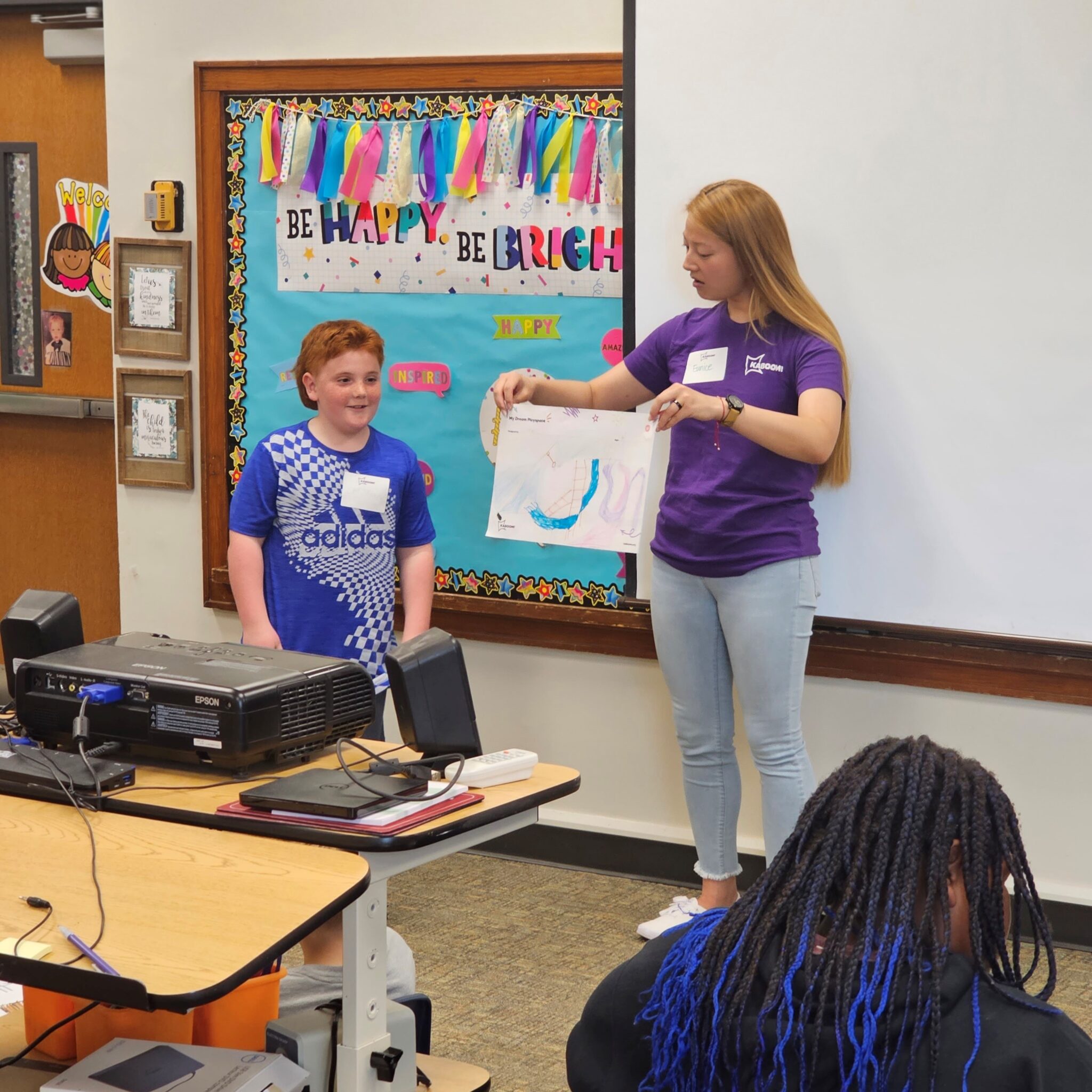

LIBERTY BELL PARK – DESIGN DAY

KABOOM! is in partnership with Integrity Marketing Group, a Dallas-based firm, and local businesses Premier Senior Marketing, Retirement Plan Consultants (RPC) and Wealth Management to bring a new playground to Liberty Bell Park.

KABOOM! provided dream pads to all Norfolk elementary school students which were available for viewing at the adult session of Design Day. Click here to see the full video of the student’s drawings.

Design Day was held on May 11th and was kicked off with the kid design session at Lincoln Montessori. The adult session was held at McMill’s Courtroom in the afternoon. The session was hosted by KABOOM! to gain insights on what the public wants at the new park including equipment and colors.

As part of the partnership, the City will contribute $8,500 with the remaining $150,000 for the project provided by Integrity Marketing Group, Premier Senior Marketing and Retirement Plan Consultants (RPC) and Wealth Management.

It’s Not Tax Season, It’s Marketing Season

Webinar Recording | January 2023

Presented by Nate Raabe

During tax season, it is the best opportunity for CPAs and advisors to market their firm by showcasing the value-added services they offer. Make sure that during your meetings, your clients are aware of the services you offer, focusing on those that are tailored specifically to them. It shouldn’t be the clients job to ask about a specific service. The advisor should proactively recognize a client’s potential needs, so they are prepared for the meeting with any necessary resources. These services could include medical reimbursement plans and managing HSA contributions, proper entity setup, estate planning, retirement strategies, cost effective investment strategies, funding IRA’s, beneficiary designation discussions, etc.

For some clients, this may be the one time of year that you have a face-to-face meeting in the office with them. Take this opportunity to tidy up your workspace. Clear clutter from your desk so that there are no distractions during your meetings. Have (up to date) business cards available for the client to take. And encourage them to take an extra card if you think they could refer an ideal client to you. Make sure your clients are comfortable and relaxed so it will be an encouraging environment for them to ask questions and discuss their financial plans and goals.

When meeting with clients during tax season, an accountant should highlight tax-savings opportunities on the Form 1040. A thorough 1040 review can present opportunities to have conversations surrounding wages, interest income, dividend income, IRAs and pensions, capital gains and losses, net operating losses, medical expenses, etc. Review the Schedule 1 for alimony, business income, partnerships/S corps, farm income, unemployment, HSA deductions, self-employed SEP, SIMPLE and qualified plans, IRA deductions, etc. to look for potential opportunities. Review the Schedule 3 for education credits, etc.

If you are an advisor that has questions on how you can best tailor your services to help your clients achieve their financial goals, reach out to the professionals at Wealth Management.

Complete Webinar Transcript

0:01

Alright, everybody Nate Raabe here with the 2023 version of the, “It’s Not Tax Season…It’s Marketing Season recording.

0:10

To help everybody get juiced up, and excited, and thoughts through, for the marketing season is upon us now with the IRS. Just now, opening up a return to be filed here for the, for the year there. So, it’s ready and rocket in time to go sell.

0:28

The biggest thing we know, you know, for a firm can make, is a mistake, here, is to create a checklist, make you know things to do with the client after the season, and say, Hey, let’s meet up after after this and go through all that.

0:46

Well, um, it doesn’t work out well, and we call it golf, golf golf.

0:53

That’s simply the answer, but it’s a lot more, you know, kids, baseball, et cetera. All those kinds of things.

1:01

But, you have to act with people while, while they’re in the office, and while you got their attention you strike while the iron is hot in there to, to get that done. So making those lists to do that. I have a lot of you guys tell me.

1:14

Lot of our guys. Tell me. Oh, yeah, I’ve talked to 10 people I gotta follow up with them.

1:20

Uh, you know, you see maybe one of them get, get get closed and in the end in there. So I know no CPA.

1:28

I know is banging on doors looking for business because they’ve all got plenty of it to do this. Is that this? You get a strike while the iron is hot here and do that and this help hopefully, will help get people to the revenue points to where they don’t feel. They need to maybe grind over quite as many returns.

1:48

So, And also, the avoid the avoid the tax season piece of it, because it’s it’s truly marketing season between January first and April 15th. We don’t have, you know, great heart, exact stats.

2:05

And, but those are way beyond that. You know, generally the two best quarters for us for net inflows and really after April 15th, that second quarter pretty much shuts off in there.

2:18

So it’s, you know, those four months, 3.5 months, that most of that business happens.

2:23

And so it’s truly, truly, your marketing season in front of you, in here, and things to talk about while they’re people are sitting in front of you.

2:32

You know, if Medicaid Medicare medical reimbursement plan works for them, that’s great.

2:37

HSAs are talking about that a couple of times in here important thing you know, you guys know those those kinds of things?

2:45

They’re the little Small value ads to people but It can be pretty important in the in the long run in their forum.

2:52

So in the bottom part in there is, if you, if you look like you’re a disaster, you’ll project and project that declines, and sometimes they don’t even want to just bring it up with Yes.

3:05

And they’re, So, yeah, you don’t necessarily know. I talked to one the other day, then found it. I thought they would have asked me before, they did, if they had 15 grand in. Cash value life insurance for one of their kids.

3:18

For college, kids will be about 13 right now.

3:23

They done it a couple of years ago. We did, you know, there did, you know, you’re busy. We didn’t want to ask you.

3:31

We’ve got a Roth IRA set up that we’ve been dribble of money into the whole time that I’ve been getting $100 a month and here they went and put, you know, $1500 a year.

3:40

In this thing, also, this work was about half of what the the Rothfuss, so. And I did a poor job of rejecting that I think to these folks in there, so that’s, that’s my fault and that’s a good example.

3:53

So, just gotta gotta do that.

3:57

So, you know, what do we want to look for?

4:00

We all know what this form is and what it tells us and here, and these are the, the big highlights on what we want to want to want to get from talking points from those clients in there.

4:12

So, this, seeing multiple W twos for somebody, we know the last couple of years have been the great resignation in here.

4:24

People have moved jobs. Did they move that 401 K with them? What’s, what’s going on in there? There have been, you know, a lot of money, emotion in that way, so every time there is no extra W two, are they still working there? And what they do with that, with that 401 K, or 403 V, etcetera.

4:47

There we go.

4:49

And to see, the second part of this here is, if they have that, are they taking advantage of the retirement plan in there?

4:58

So, if somebody’s got X in their W two, and you don’t see anything in there in their retirement boxes in here like this, uh, that’s the, code list in Box 12. Make sure that those are in there, otherwise it is, and you know, important to get that figured out. Why the heck they’re not not taken advantage of it. Sometimes, the reasons are kind of insane and crazy, and I don’t, you can’t convince everybody, but you can.

5:26

Yeah, talk the talk, talk to folks in there about, about, doing that, Because, in most of those cases, it’s literally free money being left at the table.

5:40

This one is probably the piece, for those 2023 version of it, for the 2022 year, It’s probably the biggest change, and the most important, and where most value can be added in there, you know, if we see interest in there, you know, that old number, you used to maybe hope to get maybe 1% out of your body.

6:04

You know, that was saved in the long run for the last, you know, basically says, great financial crisis in two that the, or the global financial crisis in 2008, you know, 14 years ago, really lived in a, basically, zero interest rate environment since that period. Well, we all know that’s changed, And that’s changed a lot.

6:24

And you’ll probably see some 1099 pop up for people that hadn’t been there with savings accounts, some of those things, et cetera, that weren’t even getting to 10 bucks, or what the number is.

6:36

But also you will see some with some small numbers in there, And it’s hard to I, I’m not going to be able to give you a lot of guidance on what the exact dollars are going to be out there, because I still see a lot of banks.

6:48

You know, the large, corporate bank names of the big ones, that are still paying a quarter of a percent on savings accounts, those saying, CDs are just, you know, these anemic anemic numbers in there?

7:01

And yes, we all should have some money, set aside as an emergency fund, but is it a scenario where you can even help them with that emergency fund by getting something out of it versus a quarter of a percent? As of today, you know, that just the standard, straight, boring money market, we can, you know, money, market, mutual fund, we can get. It’s about 4.25. And we’re looking at the Fed moving here at the end, just January, and so that number, I would assume, is going to be even higher at that point.

7:33

So, this is, this is, you know, we’ve done a lot of work this way, and this is kinda one of those ways for some people, some people won’t be very receptive to it, but most people will really dream that we can help them at all in this way. And a lot of times, this way is kind of a good step to get some more or some start, if not all, all bunch of those dollars in there.

7:56

So that’s a pretty important piece there for you in there to talk about.

8:01

This year, is probably the, you know, the biggest year for that in there. Because some banks yet still haven’t really raised much at all. And we can still, you know, those, what they’re going to be paying out on a savings account.

8:15

Money market account is not going to be what we can get at, at TD and there.

8:19

So again, I kinda hard on this, but the big, big, big deal to talk about that and the other piece in there is, I got a whole boatload of it that they have too much cash and they over the FDIC limits for any one of those here, Dividend income. A couple of points there.

8:39

Yeah, we Can you see a 10 day and it’s got eight different American fun.

8:43

Name’s on it, You know, Couldn’t run an analysis and kinda figure out roughly what they are, and what that looks like.

8:49

Also there If they have a, you know, a bunch of it, And AT&T has come back that way. That’s really, you know.

8:55

We, we all have kind of an affinity to own that common stock. It’s kind of scary. If you go back and look over the last 20 years, What Some of those you know, those quote, unquote, safe names have been …, The widows and orphans style stocks that have been capitol records over these these periods where it feels like, Oh, I’ve been paid this dividend. But, yeah, you’ve lost 60, 70, 80% of the principal value of what you had over that time in there.

9:25

So some, some key points in there, and then the custody part of that, see if you can figure out, you know, whether it’s a computer share, some of those will come out and tell you whether it’s to certificate shares or shares held at Computershare.

9:40

Some of those physical chairs are still held by people, whether at Home or in Safety Deposit Boxes, and that’s just not great. Great, great scenarios. We’ve had to work with people to try and get shares replaced and that’s a mess.

9:54

So at least get deposited with the brokerage firm and there. So those chairs literally can’t be stolen.

10:01

And the line here, on IRA distributions, you know, if you see that 50,000 went out and for a 0 and 4 B, you after you input that 10 99, with those codes, with that G rollover code. I think it is about 799.

10:18

Yeah, that means that you missed out on it this time, but it’s a chance to bring that up with the client and see, see what happened to it, where it went and set the set the table for next time with them in there.

10:31

So, not a wind now, but possibly a wind down the down the road for you.

10:38

Here, you can find a whole lot out about capital gains and losses, and there, if there’s no short-term trading, I’m sure that did not go well. For 99% of the population in 20 22.

10:52

I like 2021 and 20, where it was kinda while the other directions in there might be some good talking points for folks figured out there doing it on their own.

11:02

Or if their advisor treated the heck out of their stuff, it feels like most likely, it might be on their own now, because lot of advisors are trading like that. But, boy, that was kinda the rise of the retail, for a bit.

11:14

And here, here’s one of the biggest ways to we can add value to, to folks, this: net operating loss.

11:23

I had one last year, a client I’d never asked for a tax return, just had a, you know, an IRA to do rollover from a previous employer.

11:33

Does that all right with? and then get deeper and talk about some cash last year and blah, blah, blah.

11:39

I go to tax return, it looked like, we had some farm stuff, He’s carrying a foreign laws board and we ended up converting this whole, traditional IRA, overwrought, and all we’re going to end up doing is chewing up, part of his, uh, carry for loss carry forward from the, from the prior year in there.

11:58

So, that’s a, that’s a big, big, big point in there, so.

12:04

yeah.

12:04

That’s, that I can add tons and tons of value to people.

12:10

This one here, if you’re in, kind of, unique scenarios, that does not taught, you know, not all are CPA’s advisors, who are working on the church side, but there’s a, there’s a handful of you that are.

12:20

And if they, if you look at what those AGI numbers are after those housing deductions, it’s quite possible that you can convert some dollars and not convert and not incur any federal income taxes. For doing that if you monitor those numbers.

12:37

So it’s a big thing in there, and also make sure that, you know, those folks with those super low AGI are making a Roth contribution into their deferred retirement accounts.

12:49

Couple of bigger, Big talking points to add value in there.

12:54

Medical expenses, too.

12:55

That’s where you can deduct losses and, and see, see if there’s no conversions, et cetera, that could be carried out.

13:04

Somebody’s taking a bunch out of, you know, pre-tax accounts or even out of taxable accounts, you know, recover and, uh, home care, nursing, home care, those types of things, you might be able to do some serious tax planning in those scenarios. Also.

13:25

So another another piece here, kind of FYI, alimony counts. So if somebody’s only receive an alimony, they have the ability to make make retirement plan contributions in there.

13:36

So that just little FYI there on the Schedule C, dig into, if they’ve got anybody’s putting anything in there for employees on that Line, 14 of Schedule C, Dig. Dig into that.

13:52

If they don’t have employees, we can still set up set by IRA or a 401 K for those.

13:58

For those folks here yet to, you know, knocked down from 20 22 income, if they do and you don’t really want to get into that, it’s probably time to get a simple setup for some of those folks.

14:08

If you have, employees, don’t want that added complexity to it in there.

14:15

And here, you know, if they’re part of an S corp, ask, ask about that. You know, you go to the Big Time, doctor group or big-time money coming through, type things.

14:25

You can get as cute as A, you know, 401 K cash balance combo, or as simple as a simple dependent on how that employer works in their profitability, and there, and if you have a trust return, uh, some of you might be doing more of those than others. Where are those average assets, and how are they being managed at that point?

14:48

Here, looking at a farm income question, essentially, schedule F same, same set of concepts, and there is, no, you know, no paid employees.

15:00

Um, I 401 K, knock some of that income back.

15:04

A lot of them probably tax plan around fair amount of that.

15:08

We know that there were a lot of people in agriculture the last couple of years that made a lot of money in there, so there’s giant deferred tax liabilities, and I don’t have a cash balance thing on there, but there’s probably some of those where those might make sense in some of those scenarios in there.

15:28

And if they’re really, really, really high and some of those scenarios you might be looking at, No, not, yes, I think whoever is like 900,000 where you’re not getting government payments any longer, so you might be needing to work your way down, even off in that scenario, to help those folks.

15:47

See anything, no another FYI there, They’re obviously not employed by XYZ anymore.

15:54

So possibility for rollover and this HSA deduction, that’s kind of a kind of a big deal, also really how to, how to work that? How to set that up?

16:05

You know, you get you have the information in front of you whether they’re taking money out of that HSA. You know, some people really you know money in money out. The way they need to operate that, but also that HSA, that triple tax benefit. I think I’ve talked about that a little bit later here.

16:21

We want to want to want to at least bring that up. An arrogant, because that’s a big, big deal, and if they get the balances, we can work our way to managing some of those balances for folks eventually. So, yeah.

16:36

And here, that’s where the line to see if they’re worthy at, you know, if they’re writing a check to TV, or reading it, ameriprise, or Edward Jones, et cetera, you can talk about, you know, a good time to bring it up and just take a look, take a second look at it in there.

16:55

Ads, same same concept in there, or talk about, well, you know, your income fallen into 12% range, he or she really making a Roth contribution. You’re really making a Roth contribution instead of this pre-tax contribution.

17:11

And only getting a 12% deduction for it.

17:15

Here, the biggest thing on the education stuff, I think, is for those in Nebraska, there, you know, you can have a work. You know, the self-employed, you can mess with the credit. and if it’s, you know, in Nebraska, are you making that deduction in Nebraska, on the Nebraska state income, tax return in there? Somebody made made contributions to kids in that way.

17:38

So, other things to think about that educational planning, you don’t put the money in the kid’s name.

17:50

529 discount for that, but a Roth, you know, if it’s a self-employed or they have Roth IRA, retirement money, that doesn’t count into calculations, et cetera.

17:59

So you just don’t want to have that in there if they’re going to possibly be getting aid up there. You know, everybody’s got income and stuff, and it’s a different story.

18:10

You can use can use that, ros and there you can go after those.

18:15

Uh, contributions into that, no harm, no foul and let the earnings sit for quite a long time in there.

18:22

And other tax, law harvest, if you know somebody had a bunch of XYZ, no Internet, Tech stock, things that they had had previous. And, well, we all know, kind of what happened was a lot of those tech names.

18:35

Yet, Zoom or peloton in that portfolio, Hello, before, uh, those losses are pretty significant today, and the other part here, you know, talk about those crypto holdings.

18:46

I think there’s more education on it now, but, man, if somebody had bought, you know, Bitcoin, 60,000, and here we are around July 22,000, you can harvest harvest some of those, those things, I think, that direction.

19:02

Here, this one’s, you know, the quirky one, we talk about that backdoor Roth IRA concept in there, what that means.

19:12

You know, people have too much income, know, Rob, that you’re married, filing joint 300,000 for the single, you know, just rough numbers.

19:21

But, if they’re above that, and can’t make that direct Roth contribution yourself, there’s, you know, the whole backdoor methodology process, too, to get to that point in there, to make that happen up the courts there, you can’t have any other IRAs, et cetera, You know, somebody has that, go. And you can form a High 401 K, just to drop out those dollars into, in that direction, to cover that, et cetera.

19:50

What can you move that out to make those non deductible Roth contributions, and then immediately convert them in there to get that backdoor Roth?

20:00

So, that’s, that’s real important. Especially on the higher ed. And those we know are the people that are generally working with you on the, the tax advice side of things here.

20:11

We get into this Secure Act stuff.

20:16

We know what the, there’s quirks in there with now needing there. Accelerating the RMBS on the IRAs, I think most of you know that.

20:28

But, you know, thinking about that for, for parents and they’re if they’re in the, if they’re in a lower bracket and they have kids who are not in lower brackets, It’s probably a good idea to convert some of those dollars from pre-tax to after-tax in there.

20:47

Leave less of that burden, that way, you get a tax less going on in there. So That’s kind of the big thing. There’s a bunch of stuff that narrow secure act.

20:57

I touched on that on the webinar a couple of weeks ago, or whenever that was the monthly, you go back and watch that piece out of, there. They get hit a lot of those pretty hard at that point in there.

21:15

Talking about the assets in here, you have the DOD’s on them and it’s not just this That means, you know, just accounts here.

21:23

It’s accounts everywhere And do they have beneficiaries set up right in other places, too?

21:34

Roth IRAs, great.

21:36

Great scenarios, time to get, get, get those dollars it there while you can, and you can set it up on that monthly, helps, You know, some people can’t write that $6000 check, or so at the end of the year, but they can, you know, they can find a few bucks during the year and there actually helps you dollar cost average day overtime and there, so that you don’t you can have the whole dollar cost averaging versus lump sum conversations.

22:03

But getting it in overtime, smooths some of that out and helps people jumped through some of those hurdles mentally.

22:11

So those are those are positive things in that way, and that’s what I have for you today.

22:17

I hope I was not too boring for anybody here with that. But just wanted to say thanks all for listening. And don’t hesitate too.

22:29

Reach out if you had any questions over anyway. All right, thanks, everybody. Have a good one.

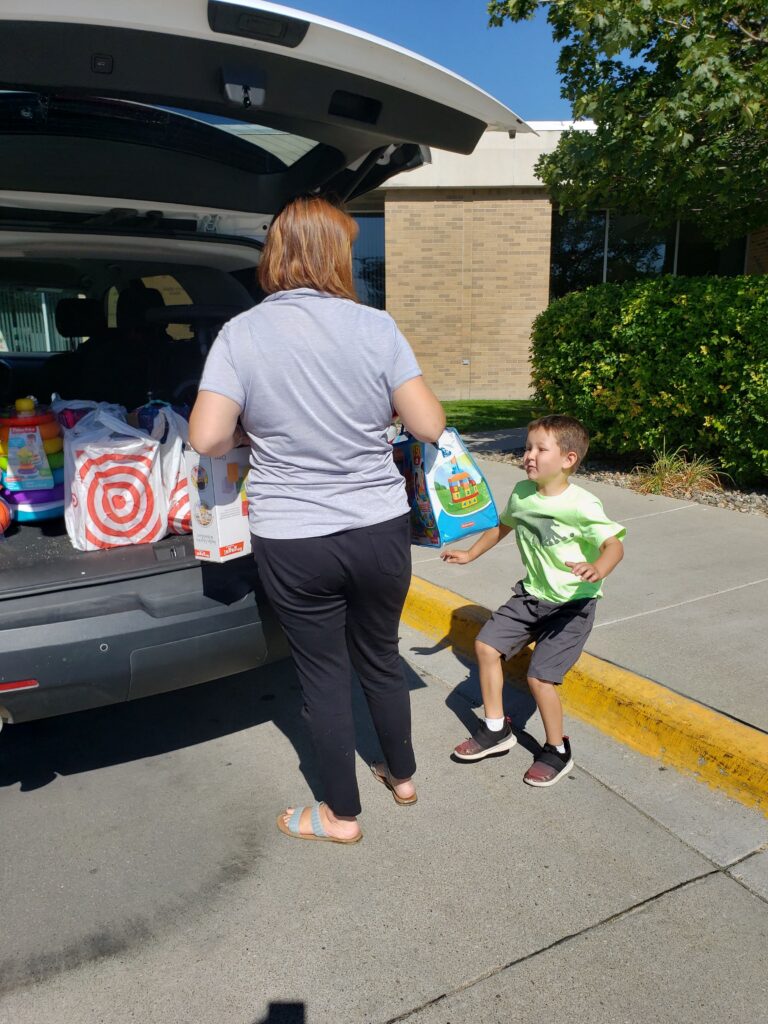

Christmas in July!

Last month, we held a 🎄“Christmas in July”🎄 toy drive and challenged our staff to collect as many toys as we could for pediatric patients at Faith Regional. The generosity of our employees and their families was clearly displayed as we were able to donate over 300 toys! Thanks to our employees and their families for supporting the community that we love! 🥰 We hope this will brighten the day for many young patients! 🧸🪀

Lemonade Camp 2022

Our largest camp yet, 80 kids attended! Campers raised $955 for the Norfolk Library Foundation!

Check out the article written by The Norfolk Daily News!

https://norfolkdailynews.com/news/lemonade-camp-raises-nearly-1-000-for-local-nonprofit/article_214e46f4-172c-11ed-8278-33069af128c6.html